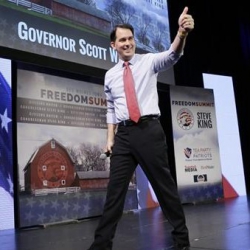

Opponents of gambling in Wisconsin are fighting a measure by Governor Scott Walker which would increase spending on gaming ads. Gov. Walker proposed a 40% increase in funding for advertising, but Citizens Against Expanded Gambling launched their own public relations campaign to stop Walker’s move.

If Scott Walker got his way, the Wisconsin State Lottery would spend $10.5 million to advertise ticket sales. The proceeds from increased ticket sales would go to property tax relief, according to the governor.

Lorri Pickens on Wealth Redistribution

Lorri Pickens, a spokeswoman for Citizens Against Expanded Gambling, spoke out against the governor’s plan. Picken said, “People in the poorest zip codes are playing the lottery and that is where the majority of advertising dollars are spent. All for a property tax credit on average of $107 per property owner who actually applies for the tax credit.”

Pickens continued a withering criticism of the proposed new funding for the lotto. She pointed out that the lottery do not create wealth they way other businesses do; that it simply redistributes the wealth from the middle class and working poor to those with resources and assets.

Pickens added, “When you look at the cost of gambling to Wisconsin families, it’s a pretty big trade off for a small return….It’s a conflict of interest for government to engage in state-sponsored gambling. Its duty is to protect the citizens, not be involved in entertainment.”

5 Years of Record Lottery Sales

In the wake of the criticism, local media outlets have noted that the Wisconsin State Lottery does not need the help. The lottery has had record ticket sales each of the past 5 years. Those same media sources have noted that lottery spending is an inefficient way to lower property taxes. Despite record sales, Wisconsin homeowners have seen the tax relief increase only 9% from lottery revenues since 2007.

Wisconsin GOP members might say this is another example of Democrats stirring up class warfare, pitting wealthier property owners against the working class lottery gamblers. In such a case, the natural rejoinder is that people of all economic classes play the lottery and buying a lotto ticket is a decision they make. Freedom to spend one’s money the way one wants is the principle at stake.

Who Is Behind Citizens Against Expanded Gambling?

On its surface, Citizens Against Expanded Gambling does not appear to be led by Democrats. It is a socially conservative group. While it seeks to protect people from social problems like compulsive gambling, the group also is trying to stop the expansion of a vice — gambling.

Like media critics have noted, the decrease in property taxes would be mininal. Offsetting that is increased problem gambling, more wealth going to corporations instead of people, and Wisconsin becoming more entrenched in state-run businesses.

Lawmakers Critical of Scott Walker

For that reason, Wisconsin lawmakers on both sides of the aisle have criticized Gov. Scott Walker’s plan. Ten years ago, the Wisconsin government sought to increase spending on lottery ads.

Economic Planning and The Trump Boom

That expenditure was approved, but it came at a time the global recession hit. With the subsequent collapse of the banking and real estate markets and the resulting loss of jobs and homes, the Wisconsin Lottery had a severe decline in lottery ticket sales.

People do not expect to see the stock market collapse in early 2017. With a long-promised tax cut for corporations, slashing of regulations, and focus on keeping jobs in the American midwest, a so-called “Trump Boom” has taken the stock market over 21,000. The S&P 500, considered by many to be a more telling market for the US economy, is around 2,400 and is in a 3-month climb. Yet lawmakers appear as if they have little interest in Scott Walker’s lottery advertisements.

Wisconsin Electoral Politics

If a collapse happens, then it likely would come after the tax cuts increased investment and spending, while deregulation leads to the lack of transparency which fosterd the 2008 collapse. That is going to take months and months. Gov. Scott Walker likely could get away with increased government funding as another way to lower property taxes, but even members of his own party do not like that idea.

Such is life in a traditional Democrat Party stronghold which has gone Republican in the last few election cycles. The lawmakers on both sides want to be seen as advocates for the middle class, so they are leery about a bill which seems to help well-to-do Wisconsin residents — at least when it does not help that constituency that much.