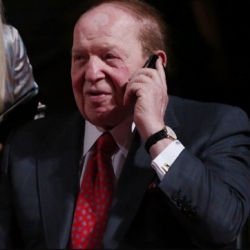

Sheldon Adelson, the 84-year old founder and CEO of Las Vegas Sands, warned on Friday that proposed policies by Japanese lawmakers would lead to lower investments in Japan’s casino industry. Sheldon Adelson once said he would invest as much as $10 billion in a Japanese intergrated casino-resort.

The casino mogul’s warning comes at a time when the Office of Integrated Resort Regime Promotion is suggesting measures that would limit the profitability of Japan’s casinos. Japan’s Diet passed an Integrated Resort Bill last December to legalize land-based casinos, but the details were left for 2017’s legislative session.

Restrictions on Japanese Gamblers

The new regulations would make it next to impossible for Japanese middle market gamblers to play, while limiting the ability of international and Japanese high rollers to gamble. Even the size of the gaming floors in casinos would be limited to one-tenth or one-twentieth of the size of American or Chinese casinos’ gaming floors.

International Casino Developers in Japan

Since the IR Bill was passed, Las Vegas Sands has vied with US casino companies like MGM Resorts, Boyd Gaming, and Wynn Resorts, along with Chinese companies like Galaxy Entertainment and Melco International and Malaysia’s Genting Limited. The list reads like a who’s who of top international casino firms. With 4 casino licenses (likely) up for grabs, several of those top companies would have lost out in the process.

Las Vegas Sands Corp has been one of the leading companies picked to secure a Japanese casino license. Stories suggest that Sheldon Adelson wanted to build a casino in Osaka, the country’s 3rd largest city, the world’s largest port facility, and Japan’s main tourist destination. Alternately, a casino in either Tokyo or Yokohama also made sense for LVS. Now, it appears that Sheldon Adelson has cooled on the process.

Adelson Meets with Matsui and Yoshimura

According to Asia Gaming Brief, Adelson met on September 1 with Osaka Mayor Hirofumi Yoshimura and Osaka Prefecture Governor Ichiro Matsui. In the meeting, the casino executive told the Japanese officials that the current regulations would cap investment at no more than $5 billion.

Adelson said that Japan’s parliament needs to promote laws that would allow developers to build “the best kind of integrated resort“. In his mind, the best kind of integrated resort would spur developers to invest up to $10 billion in a combined casino, hotel, shopping center, and resort.

Jim Murren on $10 Billion Investment

The gaming mogul’s opinion seems to be commonely held. Jim Murren, CEO of MGM Resorts, also has stated he would invest $10 billion in a Japanese casino. Melco’s Lawrence Ho said he would spend “whatever it takes” to secure a Japanese casino license.

Despite the bold pronouncements, word has been leaking into the gambling media over the past two months that Japan’s proposed regulations would quell enthusiasm for multi-billion dollar casino investments. This is the first time that the number $5,000,000,000 has been bandied about — which is a bit of a surprise, given the many proposed restrictions.

Asia Gaming Brief previously reported that Ichiro Matsui shares many of the qualms Adelson has. Whether an official influential in Osaka will be able to convince Tokyo officials to change the current set of proposals is another matter.

Office of Integrated Resort Regime Promotion

The Office of Integrated Resort Regime Promotion is said to be following the Singapore model for success. The city-state of Singapore wanted to restrict residents from gambling in their local casinos, so they set a number of policies which would restrict play for residents. The size of gaming space for Resorts World Sentosa and Marina Bay Sands was restricted somewhat.

The problem with using the Singapore model for Japan is the fact one is a city-state, while the other is a nation of 127 million people. What works for the one might not work for the other. Conservative forces in Shinzo Abe’s government, such as the Buddhist-influenced Komeito Party, want to restrict the social impact of casino gambling. Thus, the 2017 casino regulations might follow the Singapore model, whether is makes sense or not.

What foreign gaming executives might not understand about Japan is the desire for social harmony is greater than it is in the United States. While one might say that China’s government is far more interested in social control than Japanese politicians are, Macau is walled-off from the rest of Chinese society. By most accounts, 3 of the 4 proposed Japanese casinos will be near the largest population centers. If so, then they would be well-poised to make the largest social impact possible. Thus, policy-makers want to assure they do not have a deleterious effect on the Japanese people.

One more factor drives the agenda in Japan, and this is no different than it is in other democratic societies. The majority of Japan’s residents do not want casinos in the first place. Polls consistently show that 60% to 70% of the Japanese people are against casinos. In that environment, it is amazing that Shinzo Abe’s coalition was able to pass a Integrated Resort Bill at all.